Asian stocks follow Wall St higher after Congress debt deal

Asian stocks have followed Wall Street higher after U.S. lawmakers temporarily averted a possible government debt default while investors waited for American jobs numbers

BEIJING — Asian stocks followed Wall Street higher Friday after U.S. lawmakers temporarily averted a possible government debt default while investors waited for American jobs numbers.

Market benchmarks in Shanghai, Tokyo, Hong Kong and Sydney advanced.

Congress temporarily set aside a dispute over debt on Thursday to extend the government’s borrowing ability into December. Experts say a default would have set back a recovery from the coronavirus pandemic.

The deal brought “cheer to markets,” Mizuho Bank’s Venkateswaran Lavanya said in a report. However, Lavanya warned, “concerns around the U.S. funding its government have far from dissipated.”

Also Friday, investors were watching for Labor Department employment data they hope will show U.S. employers hired more workers in September. Federal Reserve officials say employment levels are a possible factor in when the U.S. central bank might start rolling back economic stimulus.

The Shanghai Composite Index rose 0.5% to 3,587.46 as Chinese markets reopened following a five-day holiday. The Nikkei 225 in Tokyo jumped 2.2% to 28,275.52 and the Hang Seng in Hong Kong added 0.2% to 24,737.54.

The Kospi in Seoul advanced 0.3% to 2,968.77 and the ASX-S&P 200 added 0.8% to 7,313.70. New Zealand and Southeast Asian markets advanced.

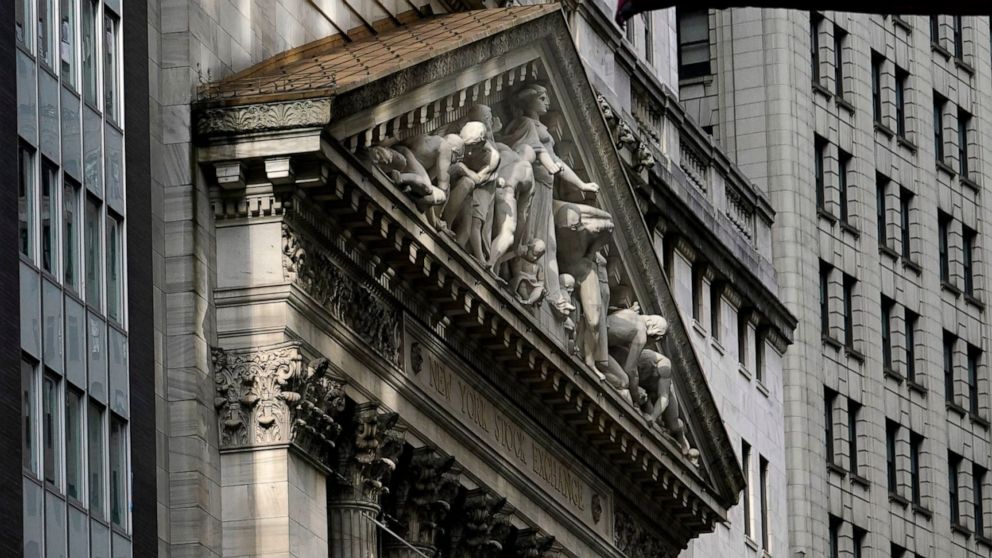

On Wall Street, the benchmark S&P 500 index rose 0.8% to 4,399.76 for its third straight daily gain. The index earlier swung between gains and losses of more than 1% for four days due to anxiety about the debt fight in Washington.

The Dow Jones Industrial Average gained 1% to 34,754.94. The Nasdaq added 152.10 points to 14,654.02.

On Thursday, the Labor Department reported the number of people applying for unemployment fell last week.

Investors are watching employment levels as an indicator to when the Fed will trim its monthly bond purchases and other support to the economy as it recovers from the coronavirus pandemic.

Fed officials responded to a spike in inflation by saying they wanted to be sure a recovery was established before withdrawing support. Stronger employment might add to pressure for prices to rise faster, which investors worry might prompt the Fed and other central banks to wind down stimulus that has boosted stock prices.

In energy markets, benchmark U.S. crude rose $1.10 to $79.40 per barrel in electronic trading on the New York Mercantile Exchange. The contract gained 87 cents on Thursday to $78.30. Brent crude, the price basis for international oils, advanced $1.06 per barrel to $83.01 in London. It added 87 cents the previous session to $81.95.

The dollar rose to 111.84 yen from Thursday’s 111.63 yen. The euro advanced to $1.1554 from $1.1550.

![]()