The bill was designed to avoid a government shutdown, which could now happen by the end of the week

The move comes after Republicans had insisted that Democrats act alone to address the debt limit and leaves Congress without a clear plan to keep the government open with the threat of a potential shutdown looming by the end of the week.

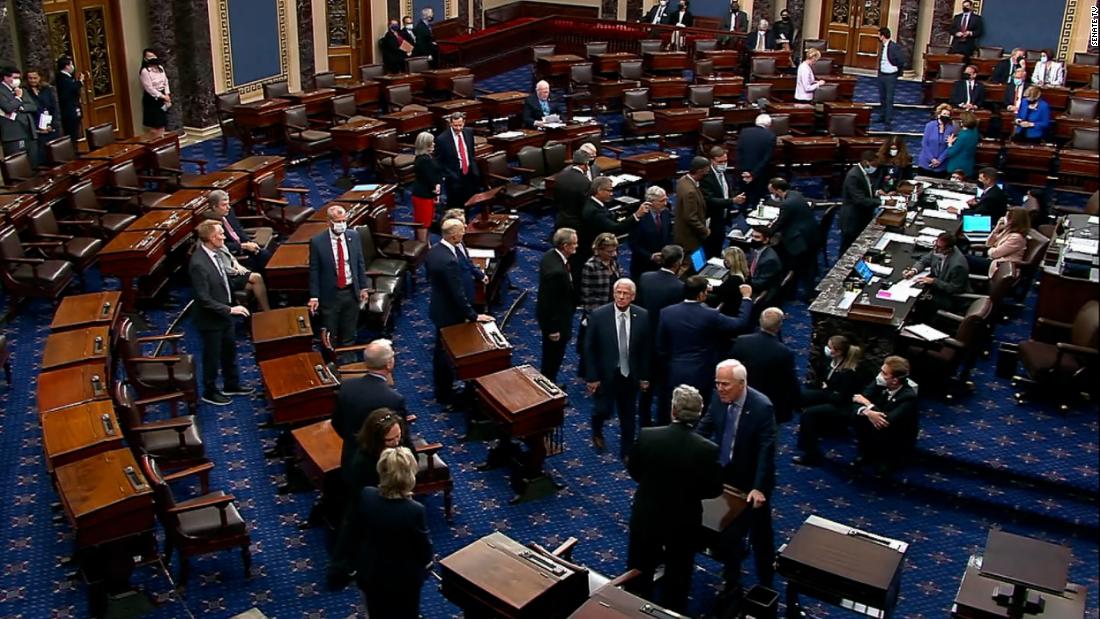

The Senate voted on a procedural motion to advance the legislation, which needed 60 votes to succeed. Since Democrats control only 50 seats in the chamber, they would have needed 10 Senate Republicans to vote in favor.

In the end, the bill failed on a 48-50 party-line vote with no Republicans voting with Democrats in support of the measure. After he voted to advance the bill, Senate Majority Leader Chuck Schumer switched his vote from a “yes” to a “no” so he could preserve his procedural ability to bring it up again.

With the measure failing to advance in the Senate, congressional Democratic leaders will now have to scramble to determine a plan B. As of now, Congress does not yet have a plan announced by Democratic leadership in both chambers about how they will keep the government operating perilously close to the date when funding will run dry and a shutdown could be triggered.

After the failed vote, Schumer promised “further action” this week to prevent a shutdown but did not outline a plan.

“Keeping the government open and preventing a default is vital to our country’s future and we’ll be taking further action to prevent this from happening this week,” he said.

It’s possible Democrats could move to strip out the debt limit suspension from the funding bill and attempt to pass a clean stopgap spending measure quickly through both chambers ahead of the deadline, which Senate Republicans have said they would support, but it’s not yet clear what will happen.

Democrats do have options to raise the debt limit on their own to prevent the US from defaulting on its debts, but they argue that the vote should be a bipartisan shared responsibility.

Schumer criticized Republicans ahead of the vote, saying, “after today there will be no doubt about which party in this chamber is working to solve the problems that face our country, and which party is accelerating us towards unnecessary, avoidable disaster.”

Senate Minority Leader Mitch McConnell has made clear for months that Republicans will not vote to increase the federal borrowing limit, setting the stage for a major showdown over the issue. McConnell’s threat has prompted outrage from Democrats, who have said the GOP leader is playing a dangerous game that could tank the US economy. Republicans argue that it’s not uncommon for the majority party to shoulder the burden for increasing the debt limit, a politically toxic vote for lawmakers up for reelection.

McConnell said on Monday ahead of the vote that Republicans are ready to support a bill to avert a shutdown as long as it does not have the debt limit attached.

“Let me make it abundantly clear one more time: We will support a clean continuing resolution that will prevent a government shutdown … We will not provide Republican votes for raising the debt limit,” he said.

“Republicans are not rooting for a shutdown or a debt limit breach,” he added.

Prior to the Senate vote, McConnell attempted to bring up a clean stopgap bill to keep the government open that would not include the debt limit provision as an alternative to what Democrats wanted to pass. Senate Democrats objected to a unanimous consent request to advance that proposal.

By attaching the debt limit suspension to the must-pass funding bill, Democrats are essentially daring Republicans to vote no and spark a shutdown.

This story and headline have been updated with additional developments Monday.

![]()