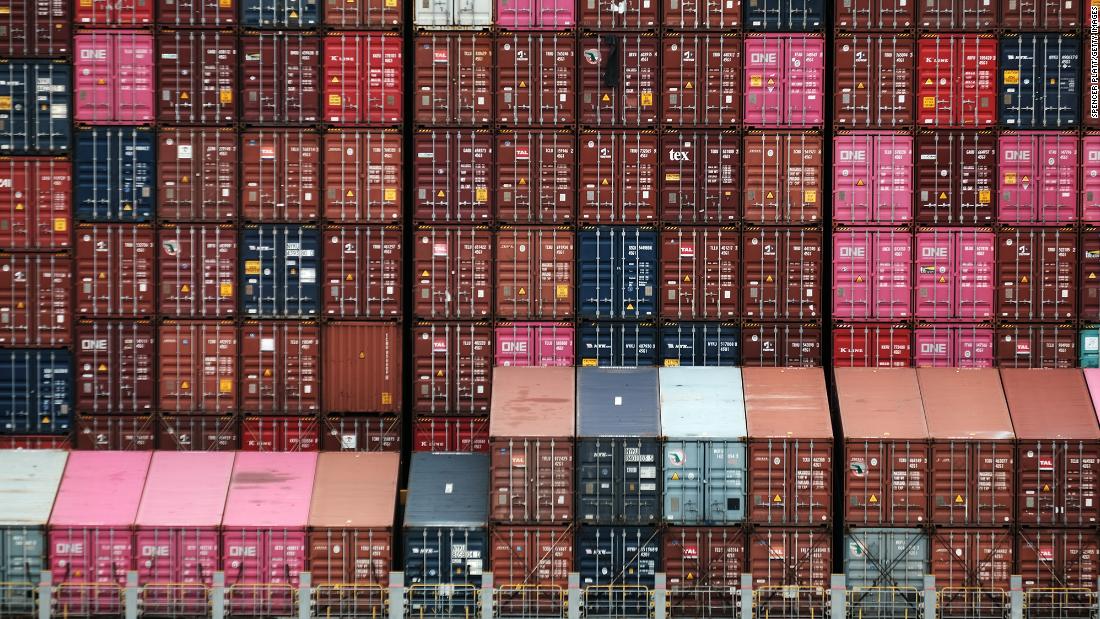

Why some say the worst of the supply chain woes are near an end

Still, some executives and market experts think the worst may be over in just a few months.

“There’s a very good chance that a year from now that we won’t be talking about supply chains at all,” Dimon said.

Others note that major companies and transportation operators are also taking steps to alleviate the problems.

Major ports such as Long Beach and Los Angeles are also now looking to keep their operations open 24/7 to deal with supply chain bottlenecks.

“Congestion issues may be past peak, with the potential for greater fluidity and volume on the horizon,” Citi analyst Christian Wetherbee said in a report last week. “This is evident in early signs of decongestion at ports in the US and Asia.”

“The global supply chain has been stretched remarkably thin,” analysts at Jefferies said in a recent report. But they added that “we may be already witnessing the worst of it,” and the “impact is likely to ease” by the first half of 2022.

Problems may persist longer than some companies expect

But it’s possible some companies and strategists are being too optimistic.

Profits could take a hit due to shipping delays. There are also legitimate worries that the problems will lead to higher prices for the foreseeable future — and that some consumers may delay purchases of non-essential items as a result.

What’s more, the issue isn’t just about shipping overseas goods to the United States. Domestic truckers may not have enough capacity to handle all the products that need to go from ports to warehouses and stores.

“Part of the inflation we are seeing in the [second half] of this year is because of the transportation tensions. Let’s be extremely clear because we see spot rates for trucks in the US at a record level,” said Juergen Esser, Danone’s chief financial, technology and data officer.

With that in mind, Esser said Danone could face higher transportation costs of about 7% to 9%. That will either wind up hurting investors with lower margins, or hurting consumers, who may find themselves paying more for yogurt at the supermarket.

![]()