Judge moves ahead with key hearing in Boy Scouts bankruptcy

A Delaware judge has refused to delay a key hearing that could determine whether the Boy Scouts of America might be able to emerge from bankruptcy later this year

DOVER, Del. — A Delaware judge on Tuesday refused to delay a key hearing that could determine whether the Boy Scouts of America can emerge from bankruptcy later this year with a reorganization plan that would compensate thousands of men who say they were sexually abused as children.

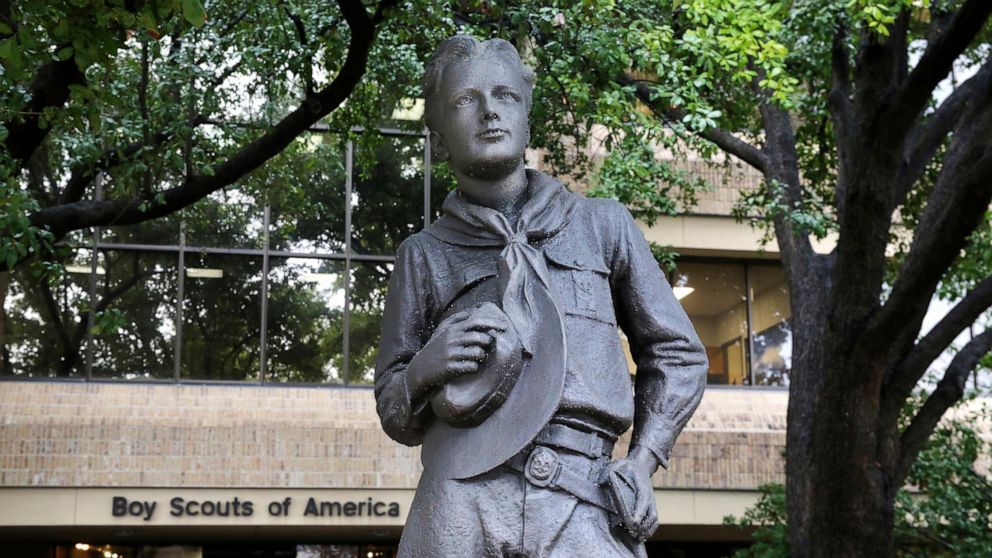

The Boy Scouts, based in Irving, Texas, sought bankruptcy protection in February 2020, seeking to halt hundreds of individual lawsuits and create a fund for men who say they were molested as children by scoutmasters and others. Although the organization was facing 275 lawsuits at the time, it’s now facing some 82,500 sexual abuse claims in the bankruptcy case.

Tuesday’s hearing was scheduled more than a month ago for the judge to consider whether the Boy Scouts’ explanation of a reorganization plan that was filed in July provided sufficient information for abuse claimants and other creditors.

Several key stakeholders asked Judge Laura Selber Silverstein to postpone the hearing for at least three weeks to allow them time to review and file objections to a new plan that was filed just days ago. The delay was sought by the official committee appointed to represent abuse claimants, along with several law firms and insurance companies. The U.S. bankruptcy trustee also said a delay was warranted given unanswered questions about the new plan and the filing of hundreds of pages of plan documents on the eve of the Jewish holiday of Yom Kippur.

Silverstein refused to delay the hearing, at which she must determine whether a disclosure statement outlining the BSA’s reorganization plan contains sufficient details to ensure that abuse victims can make informed decisions on whether to accept or reject it.

“I am very sensitive to the timing of the filing of the documents and the time frame in which attorneys have had to review the documents,” Silverstein said. “But we need to start on the many objections that have already been filed. ”

“More information, unless it’s salient information, is not always best, … but we can add the information that is necessary to make this disclosure statement contain adequate information,” the judge added.

Silverstein must approve the BSA’s disclosure statement before the Boy Scouts can send out ballots for abuse claimants and other creditors to vote on its proposed plan.

Two of the major changes in the new plan are settlement agreements involving one of the organization’s major insurers, The Hartford, and its former largest troop sponsor, the Church of Jesus Christ of Latter-day Saints, commonly known as the Mormon church.

The Hartford has agreed to pay $787 million into a fund for sexual abuse claimants, and the Mormon church has agreed to contribute $250 million. In exchange, both entities would be released from any further liability involving child sex abuse claims filed by men who said they were molested decades ago by scoutmasters and others.

The official committee, which has estimated the liability exposure of Boy Scouts insurers at more than $100 billion, has described the settlements as “grossly unfair.”

The new plan, for the first time, provides details on proposed cash and property contributions totaling $500 million into the fund from Boy Scouts’ 251 local councils, which run day-to-day operations for the BSA.

In return for combined contributions totaling up to $820 million, and the assignment of certain insurance rights into the fund, the local councils and national Boy Scouts organization would be released from further liability for abuse claims.

The official committee believes the local councils have the financial ability to contribute “several multiples” of what they are offering.

The BSA’s new plan also includes provisions under which tens of thousands of churches, civic groups and other sponsors of local Boy Scout troops could be released from liability for sexual abuse claims.

A chartered sponsoring organization could get a full release from liability in exchange for assigning its insurance rights and making a significant cash contribution to the fund. An assignment of insurance rights, without a financial contribution, would result in a limited release from liability. A sponsoring organization could also refuse to participate and keep its insurance rights, but it would receive no protection from future litigation involving abuse claims.

![]()