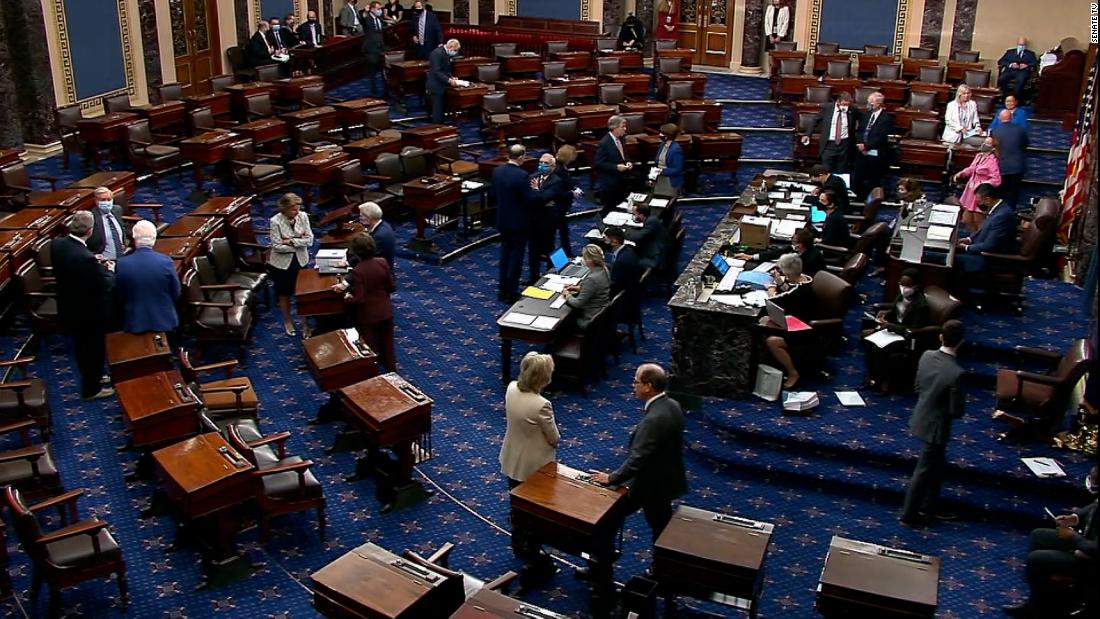

After months of negotiations, Biden notches a big win on his massive $1.2 trillion infrastructure package. It now faces an uncertain future in the House.

The bipartisan infrastructure deal that the Senate is expected to vote on leaves out President Biden’s proposal to spend $400 billion to bolster caregiving for aging and disabled Americans — the second largest measure in the American Jobs Plan.

His proposal would have expanded access to long-term care services under Medicaid, eliminating the wait list for hundreds of thousands of people. It would have provided more opportunity for people to receive care at home through community-based services or from family members.

It would also have improved the wages of home health workers, who now make about $12 an hour, and it would have put in place an infrastructure to give caregiving workers the opportunity to join a union.

Also left on the sideline: $100 billion for workforce development, which would have helped dislocated workers, assisted underserved groups and put students on career paths before they graduate high school.

The deal also leaves out the $18 billion Biden proposed to modernize the Veterans Affairs hospitals, which are on average 47 years older than a private-sector hospital.

What’s also out is a slew of corporate tax hikes that Biden wanted to use to pay for the American Jobs Plan but that Republicans staunchly opposed.

Biden’s original proposal called for raising the corporate income tax rate to 28%, up from the 21% rate set by Republicans’ 2017 tax cut act, as well as increasing the minimum tax on US corporations to 21% and calculating it on a country-by-country basis to deter companies from sheltering profits in international tax havens.

It also would have levied a 15% minimum tax on the income the largest corporations report to investors, known as book income, as opposed to the income reported to the Internal Revenue Service, and would have made it harder for US companies to acquire or merge with a foreign business to avoid paying US taxes by claiming to be a foreign company.

Read more about the bipartisan infrastructure deal here.

![]()