The child tax credit is the biggest government benefit since Social Security — but for one year only

With Social Security the government makes sure older Americans won’t fall into poverty. With Medicare it makes sure they have health insurance. With the Affordable Care Act it helps other people who need it buy health insurance.

Now it’s trying to make sure American kids have money coming in every month. This is a very big deal. But it’s a single-year experiment for now, unless Democrats can figure out how to force it through the Senate again and make the greatly expanded credit permanent.

Most parents qualify. Unlike food stamps — now called Supplemental Nutrition Assistance Parogram, or SNAP, benefits — or other welfare programs targeted only at the poor, this new credit is much larger.

More than just parents in dire need got up to $300 per child deposited in their bank accounts Thursday. This program, an expansion of an existing tax credit, will help the middle class and even people making hundreds of thousands of dollars.

Some of the tax credit will be claimed next year at tax time, but the big change is that a chunk of the benefit is being paid directly to parents in advance, offering a monthly boost.

The US has been inching toward this kind of social benefit for years, in increments, and on a bipartisan basis, although not in a bipartisan way.

Republicans doubled the child tax credit to $2,000 per child with their massive tax cut bill in 2017, but they rejected this new expansion, which Democrats tucked into the Covid assistance bill they passed in 2021.

Now Democrats are calling for it to be cemented into US law.

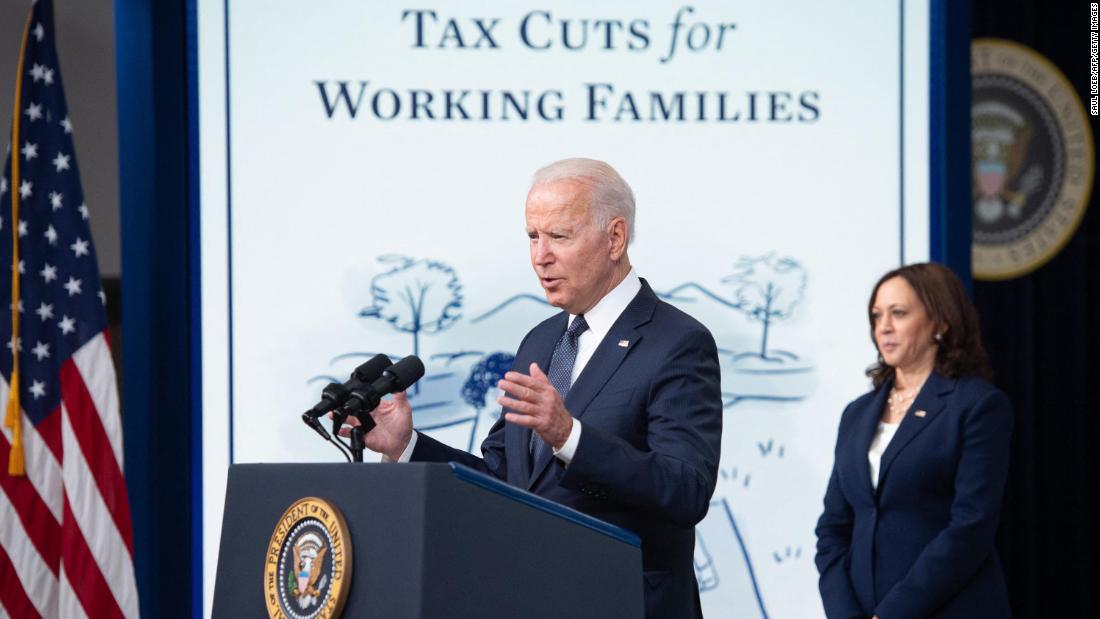

“Let us mark this day, Thursday, July 15, 2021, as the day the American family got so much stronger,” Vice President Kamala Harris said during remarks with President Joe Biden in Washington. “It is a good day, America.”

She took some credit for insisting the credit be paid monthly, which helps parents most in need cover expenses all year long. She also argued the benefit will help kids after they are grown, by improving their health and quality of life now.

“The payments may be monthly, but the impact of this child tax credit will undoubtedly be generational,” she said.

Is this a tax credit or a welfare program?

Democrats are careful to refer to these payments as a “tax cut,” as Harris did Thursday. Republicans, like Sen. Marco Rubio of Florida, call it “welfare assistance.” I asked CNN’s Tami Luhby, who covers health care and public assistance programs, for her take on this:

LUHBY: Both sides have a point here. The child tax credit has existed for years and won bipartisan support, including from Rubio, who pushed to increase it as part of the 2017 GOP tax cuts. But that’s largely because it was available mainly to families who work — you had to have some income in order to claim it.

The American Rescue Plan made a fundamental change to the credit, making it fully refundable for 2021. That allows far more families — including the lowest-income Americans who don’t have jobs — to claim it. More than 26 million needy children will now be eligible for the full credit thanks to this change, a key tool in the Democrats’ push to reduce child poverty.

About 1 in 7 children were in poverty in 2019, according to the latest census data. The changes to the credit, including beefing up the amount, are expected to slash child poverty nearly in half this year.

But it’s also caused an uproar among Republicans, who are calling it welfare.

Eliminating the income requirements does make it more like a government assistance program — albeit one that’s also open to most middle- and upper-middle-class American families. Many advocates for the expanded child tax credit, however, liken it to a child allowance or universal basic income program that supports most families in the US.

For comparison, the Pentagon asked for $715 billion for its 2022 budget. This expansion, therefore, is worth about a seventh of the Pentagon budget in 2022.

The first checks. If I was surprised to see a check pop into my bank account this morning from “IRS TREAS 310 CTC”, I’m sure millions of other Americans were too. There’s no first check that went out, since the IRS has so many people’s bank information and the agency just hit some buttons.

It wasn’t so after Social Security was signed into law in 1935. The first checks didn’t go out until 1940, after people had paid into the program for a few years. We know exactly who got the first check. It was Ida May Fuller, a legal secretary in Ludlow, Vermont.

According to the Social Security Administration, she “worked for three years under the Social Security program. The accumulated taxes on her salary during those three years was a total of $24.75. Her initial monthly check was $22.54. During her lifetime she collected a total of $22,888.92 in Social Security benefits.”

Inflation! That $24.75 is equivalent to about $480.32 today, according to an inflation calculator, a 1,840.7% rate of inflation. A dollar went much further back then.

Random thought about government intrusion. Some portion of the country is extremely nervous about someone who works for the government knocking on their door to encourage them to get vaccinated.

I legitimately wonder how the anti-government-intrusion parents will react when they see new monthly government payments show up in their bank accounts without asking for it. I bet they’re more OK with it. But we’ll see.

![]()