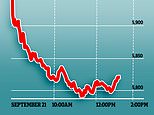

FTSE plunges three per cent or 194 points down to 5,813 amid new Covid lockdown fears

FTSE 100 suffers worst plunge since June amid dire warnings of more coronavirus restrictions from Chris Whitty and Patrick Vallance as pubs, hotels and businesses say they will not survive ‘disastrous’ second lockdown

- The FTSE 100 suffered its worst plunge since June this morning, slumping 3.56 per cent to 5,812 points

- The Government’s top scientists warned the UK faces 50,000 new daily cases by the middle of October

- Ministers have been warned another lockdown could be the final nail in the coffin for already struggling firms

- Richard Lim, chief executive of Retail Economics, told MailOnline: ‘A second wave is going to be disastrous’

London ‘s blue-chip stock exchange slumped 3.56 per cent to a two-week low of 5,812 this morning

Fears of a second coronavirus lockdown have shaken market confidence and set alarm bells ringing for businesses still in ‘survival mode’ from the first wave.

The FTSE 100 suffered its worst plunge since June this morning, slumping 3.56 per cent to 5,812 as the public were warned about the accelerating spread of Covid-19.

The government’s top two scientists, Professor Chris Whitty and Sir Patrick Vallance, today said the UK faces 50,000 new daily cases by the middle of October if the disease is not brought under control.

In a televised press conference, the chief medical officer and chief scientific adviser said the country had ‘in a bad sense literally turned a corner’ and could be seeing 200 daily deaths by November.

Their sobering intervention sets the stage for a tightening of restrictions when Boris Johnson addresses the House of Commons tomorrow.

But ministers have been warned that the re-imposition of draconian curbs will be a hammer blow for businesses already grappling with steep losses.

Shops, pubs, hotels and travel companies – which bore the brunt of the initial lockdown – will be in jeopardy, experts have warned.

Richard Lim, chief executive of Retail Economics, told MailOnline: ‘A second wave is going to be disastrous for the retail sector.

‘One of the most important points is that retailers are trying to recover from the first lockdown. Many are still in survival mode and are trying to cut costs, and are getting help from the government. If we have another wave it’s inevitable some retailers will fall into administration.’

Businesses will also be panicked by the threat of a second lockdown in the coming months as it could see them miss out on the lucrative Christmas period.

Stressing that the ‘timing’ was a big source of concern, Mr Lim said: ‘We are approaching Christmas which is the most important time for retailers.

‘If there are restrictions on how many people can meet, or households mixing over Christmas, it will put even more pressure on retailers.’

Sir Patrick Vallance today warned the UK could face 50,000 new coronavirus cases by mid-October if the spread of the disease is not curtailed. He is pictured alongside Professor Chris Whitty in Downing Street this morning

Oxford Street lies quiet today as the accelerating rate of coronavirus infections in the UK threatens a second lockdown

The looming likelihood of a second lockdown is already being felt by big travel firms whose share prices are plummeting.

British Airways-owner IAG plunged 12.6 per cent on the FTSE 100 today, a blow to the national flag carrier which is already burning through £20million each day and is facing the worst crisis in its 100-year history.

Richard Hunter, head of markets at Interactive Investor, told MailOnline: ‘The threat of another lockdown is what’s really weighing on the markets today.’

The FTSE rally which followed the easing of the first lockdown fizzled out this month as the spread of the virus began to accelerate.

Mr Hunter said that the end of the year was always going to be tough with the furlough scheme ending and the potential for unemployment. But the ‘question mark’ hanging over the fortunes of the fourth quarter are ‘now getting bigger’.

He added: ‘If the PM were to stand up in the next half an hour and say there’s not going to be another lockdown, the FTSE would recover.

‘But international investors have decided the British market is just too difficult at the moment.’

British Airways-owner IAG plunged 12.6 per cent today, a blow to the national flag carrier which is already burning through £20million each day and is facing the worst crisis in its 100-year history

Health Secretary Matt Hancock today suggested pubs could face restrictions to tackle the spike in Covid-19 cases.

Asked in a television interview if people would be able to go to the pub this weekend, he told ITV: ‘We’ll be absolutely clear about changes that we need to make in the very, very near future.

Asked if that meant no, he replied: ‘It’s not a no and it’s not a yes. We’ve been working on this all weekend, we haven’t taken the final decision about what we need to do in response to the surge that we’ve seen.’

Shares in Britain’s listed pubs and restaurant groups, including JD Wetherspoon, Mitchells & Butlers, Marston’s and Restaurant Group, fell between 9 and 18 per cent on the stock market.

Pubs have been open since July 4 and have been thriving in the warm weather while enjoying extra footfall driven by the government’s Eat Out to Help Out half-price meals scheme.

Capacity is still restricted by strict social distancing rules, which has led many to erect outdoor seating areas to accommodate more customers.

Yet with the sunshine forecast to end this week, chilly and wet weather could rule out this al fresco dining and be a further blow to the pub trade.

With the sunshine forecast to end this week, chilly and wet weather could rule out this al fresco dining and be a further blow to the pub trade

An index of travel and leisure stocks, already among the biggest decliners this year, tumbled 5.6 per cent. The mid-cap FTSE 250 fell 3.1 per cent to its lowest in nearly two months.

Michael Hewson, an analyst at CMC Markets UK, said: ‘The possibility of new lockdowns is leading the market to be absolutely risk-averse toward consumer-facing sectors like travel, restaurants and retailers.’

Fashion retailer Superdry sank 12.8 per cent after posting an annual loss due to lockdown-led store closures, while the world’s largest exhibitions group, Informa Plc, fell 2.8 per cent as it reported a half-year operating loss.

Aero-engine maker Rolls-Royce plunged 9.6 per cent to its lowest since 2004 after it confirmed it was considering a rights issue of up to £2.5billion.

Concerns of another lockdown were today compounded by an investigation into money laundering which implicated two big banks.

A slide in HSBC, Standard Chartered and Barclays drove today’s FTSE plunge amid allegations they moved illicit funds over the past two decades.

HSBC, already trading at decade lows, slid 4.2 per cent, while Standard Chartered dropped 4.1 per cent to its lowest since 1998. Barclays tumbled 5.9 per cent.

![]()