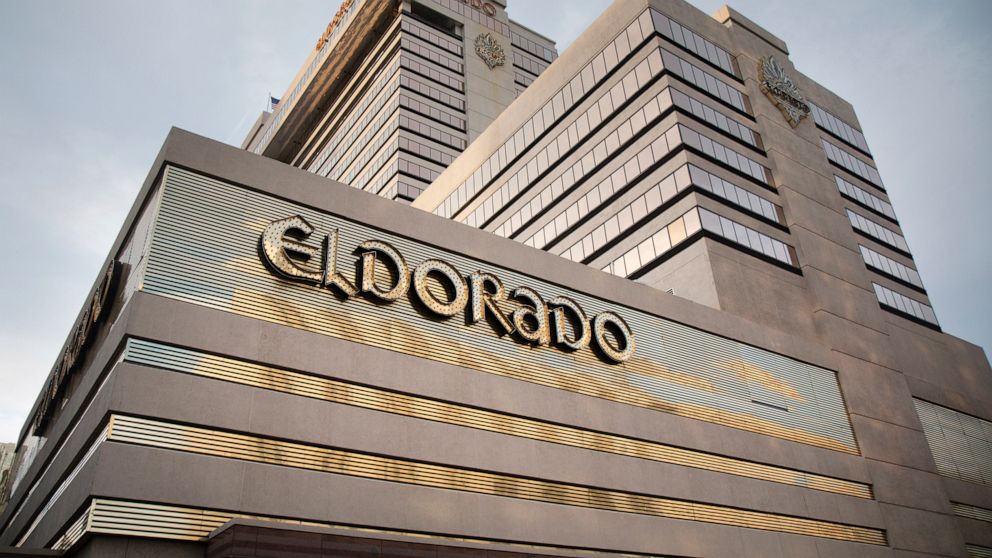

New Jersey regulators take up Eldorado plan to buy Caesars

New Jersey gambling regulators are considering Nevada-based Eldorado Resorts Inc.’s plan to buy Caesars Entertainment Corp. in a sweeping $17.3 billion deal affecting four of nine casino properties in Atlantic City

By

KEN RITTER Associated Press

July 15, 2020, 11:11 PM

3 min read

New Jersey gambling regulators began Wednesday to consider Nevada-based Eldorado Resorts Inc.’s plan to buy Caesars Entertainment Corp. in a sweeping $17.3 billion deal affecting four of nine casino properties in Atlantic City.

Approval by the New Jersey Casino Control Commission could come Thursday, and would be the final hurdle in Eldorado’s bid to become what Commissioner Alisa Cooper called “the biggest gaming company in the world” — a casino giant controlling 52 properties in 16 U.S. states under the Caesars Entertainment brand.

“Atlantic City is going to be a significant piece of this combined company,” Eldorado chief executive Thomas Reeg testified at a daylong video hearing streamed on the internet.

Company executives acknowledged previous understaffing at Atlantic City properties and promised that future job cuts at the combined company’s properties would be cleared first by state regulators.

A $25 million sale of Bally’s Atlantic City hotel-casino by Caesars Entertainment and VICI Properties to Rhode Island-based Twin River Worldwide Holdings is pending. That would leave Eldorado with three resorts within driving distance of New York and Philadelphia: Caesars, Harrah’s and the Tropicana Atlantic City.

The company is committing to keeping the properties open for at least five years. Eldorado Chief Financial Officer Bret Yunker promised $400 million in improvements to the three properties over the next three years, followed by reinvestment of 5% of revenues annually.

“Atlantic City, where it sits, is in the middle of a gigantic population center,” Reeg said. “It’s our job to make our properties attractive enough for people to get in the car or get in that charter plane.”

Nevada casino regulators approved the buyout last week, affecting properties that include Caesars Palace, Paris Las Vegas, Planet Hollywood, Flamingo and Linq on the Las Vegas Strip.

Indiana casino regulators approved the deal on Friday with a requirement that the merged company sell three of its five casinos there. There are 13 state-licensed casinos in the state, and one tribal casino. The Indiana Horse Racing Commission gave approval Monday.

The Federal Trade Commission accepted the plan June 26, after Eldorado agreed to sell properties in Kansas City, Missouri; South Lake Tahoe, California; and Shreveport, Louisiana.

Finalizing the cash-and-stock purchase plan took more than a year and was delayed by casino closures nationwide due to the coronavirus pandemic, Reeg and other company executives said.

Reno-based Eldorado would retain 56% of the merged company. It would continue operations and stock trades under the name Caesars Entertainment Inc. Executives and regulators on Wednesday repeatedly referred to it as “new Caesars.”

Billionaire American investor Carl Icahn would own more than 10% of the combined company and would be the largest single shareholder, Reeg said. Icahn acquired a large number of Caesars shares after the company emerged from bankruptcy protection in late 2017, and pushed for the sale.

————

This story has been corrected to say the number of company casinos in Indiana is five, and the number of state-licensed casinos is 13. There is also one tribal casino.

————

Ritter reported from Las Vegas.

![]()