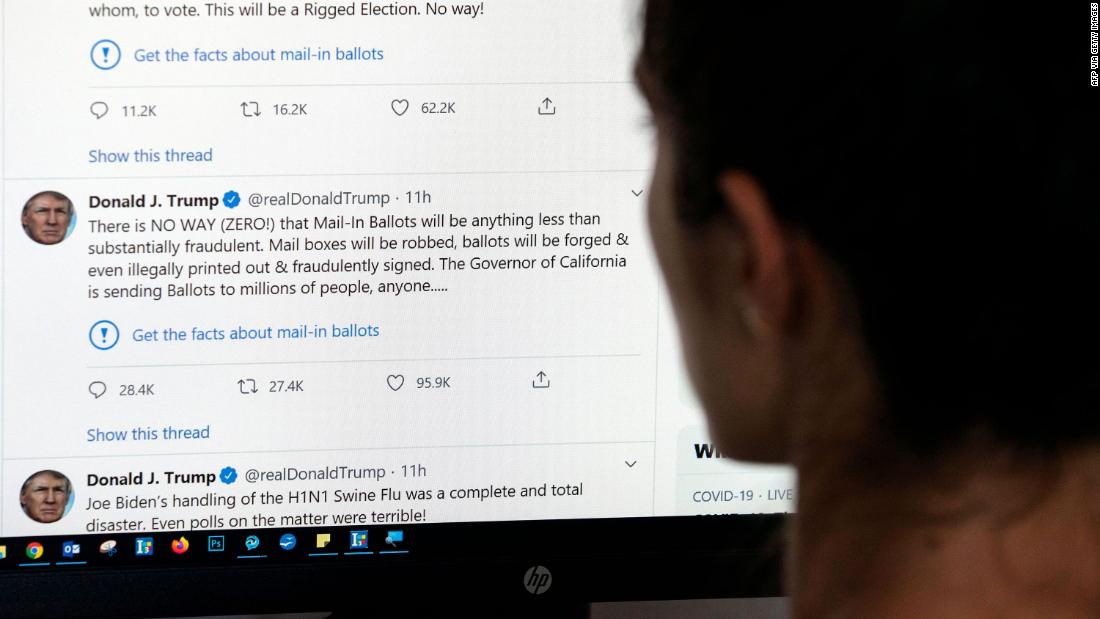

Facebook and Twitter shares fall as Trump targets social media

Trump then accused the social media company of censorship, warning that if it continued to tag his messages, he would use the power of the federal government to rein it in or even shut it down.

The most obvious course of action would be for Trump to seek changes to the Communications Decency Act, which shields tech platforms from legal liability for a wide range of online content.

There has been an ongoing push, led by the Justice Department and Republicans in Congress, to do just that. But changing the law would require building broad consensus in a deadlocked Congress. The Trump administration could not go it alone, according to Brian.

Trump could pressure federal agencies to take action against social media companies. But the Federal Trade Commission and the Federal Communications Commission have previously resisted efforts by the White House to regulate political speech.

Investor insight: The president’s clash with tech companies comes at a delicate moment. Unlike most American firms, these companies — which are used to working remotely and do not rely on physical locations for sales — have performed strongly throughout the pandemic and have helped to drive the stock market recovery.

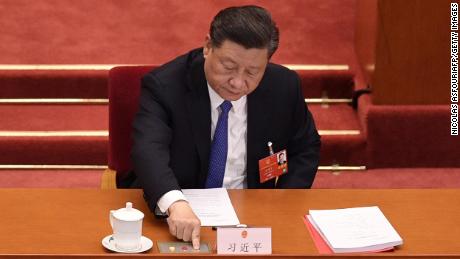

China approves controversial Hong Kong national security law

China’s legislature has approved a proposal to impose a highly contentious national security law in Hong Kong, throwing the semi-autonomous city’s future as a major financial center into doubt.

The law has sparked widespread protests in Hong Kong and has been denounced internationally, with opponents warning it could curtail many of the rights and freedoms promised to the city when it was handed from British to Chinese rule in 1997.

What it means: “We do not currently expect these developments to directly threaten the Phase One trade deal though pressures are rising,” Eurasia Group analysts said in a note to clients Wednesday. “Tensions over Hong Kong are part of the geopolitical rivalry that has contributed to the recent downturn in the US-China relationship, and introduction of this national security law came more quickly than we expected.”

Market reaction: Hong Kong’s Hang Seng has dropped more than 5% in the past week. Elsewhere, investors have shrugged off the risks, pushing stocks higher.

More stimulus

Europe and Japan are taking big steps to ensure their economies can recover as they begin the gradual process of ending lockdowns.

Europe’s plan still needs to be approved by the 27 EU member states, with the aid unlikely to arrive before 2021. But the moves are a sign that countries aren’t shying away from unprecedented help at a moment of dire need. That’s helping support investor sentiment as restrictions on movement ease.

“The sweet spot for a risk-on rotation is now, as economies reopen and more fiscal programs are implemented,” Evercore ISI’s Dennis DeBusschere told clients.

Up next

The number of initial US unemployment claims filed last week arrives at 8:30 a.m. ET. Economists surveyed by Refinitiv expect another 2.1 million.

Also today: US durable goods orders for April and the second estimate of US GDP for the first quarter also post at 8:30 a.m. ET.

Coming tomorrow: US personal income and spending data, along with the latest reading of the University of Michigan’s consumer sentiment survey, will shine a light on consumer behavior at a crucial juncture.

![]()